The SaaSy Cloud: Evolution of Enterprise Software

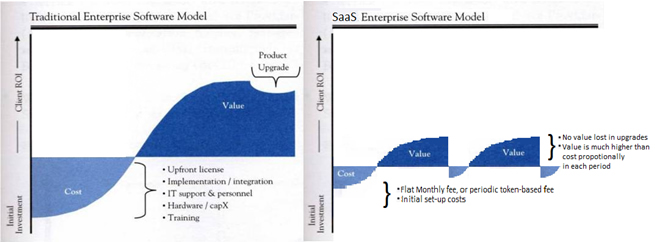

The secular rise of the cloud and SaaS has permanently evolved the business models, pricing and marketing practices of the enterprise software industry. Indeed, even the line between enterprise and consumer applications has also become less clear, as enterprise IT departments have less control of applications used within the enterprise, with rogue users in operating units using SaaS or cloud based business applications without involving enterprise IT. The applications themselves increasingly resemble the applications used by consumers out of the enterprise, both in look-and-feel and in their thin-client, browser-based (or even mobile) delivery. The primary ways in which enterprise SaaS are delivered are through a subscription model, either in a periodic fee or credit flavor; a token-based system; a freemium model; and then a free model supported by related (i.e., advertising) activity.

(1)

Subscription Model

Traditional enterprise software was overwhelmingly installed on-premise; sold through a perpetual license, paid upfront; and subject to annual maintenance payments for upgrades or ongoing support. SaaS is sold differently, self-evidently as “a service”. The most common and straight-forward selling model is service subscription, which itself has two general flavors: charging a periodic fee, usually monthly or annual, typically with a series of tiered benefits that increases the number of users allowed, bandwidth caps, or other relevant factors; or selling via credits, allowing a certain number of credits per time period, that when depleted, asks the user either to upgrade the plan or stop using the service. Under a periodic subscription fee, the main features typically are kept constant, subject to the explicit tiering of features or modules in the fee structure. A credit approach generally has just one set of features.

Determining customer pricing is of course an art, with the value customers receive balanced against their perception of the cost of delivering the software and thus the “fairness” of that price. But SaaS and cloud software providers enjoy an enormous advantage over their legacy forebears in determining the first of these: constant user monitoring (anonymous aggregated data, or individually analyzed data) and increasing big data analytic capabilities allows for precise analysis of what and how customers are using software, enabling much richer conclusions about the value they are thereby deriving. And of course conclusions about this use and value can even themselves be repackaged and sold to customers as an additional product. See Bessemer’s Cloud Computing Law #8, for example. (2)

Periodic fee subscriptions often are sold subject to “Plans and Pricing” menus, with three or four tiers offered with a middle option highlighted and “recommended”. This so-called basic option demonstrates how inexpensive the product can be while the most expensive demonstrates its versatility. The recommended middle option is often described as popular, creating a peer pressure selling environment of “everybody is doing it”, and provides slightly more features (or volume, etc.) than the average customer needs. This delimited tiering tends to boost sales because limiting options tends to increase customer satisfaction (see Paradox of Choice (3) or, for the less academic, Apple’s approach to product development) while encouraging them to buy slightly more than needed.

- As scaling costs to cloud-based or true SaaS solutions are low, the customer’s perceived cost of delivering the software tends to be low; so a basic principle of SaaS is often to acquire large numbers of average users at a basic or lower-tier price point — one much lower, especially at low user numbers, than the cost on an per-user basis of a fully implemented legacy application. User (or tiering) creep can then organically increase the revenue derived from such “average (enterprise) customers”, often without the singular oversight of the enterprise IT department.

- As SaaS penetrates into more functions within the enterprise, however, a one-(or few)-size(s)-fit(s)-all solution becomes less sustainable. But customization, especially if done non-optimally (multiple code branches with sequestered functionality uniquely useful or available to one or few customers) eliminates many of the scalability benefits gained from SaaS offerings. This is a much more common business model in legacy software. The reason only large SaaS companies have this option is because it not only costs significantly more to implement, but it is also not easily scalable.

Token-Based System

Token-based systems meter cost based on some metrics of use, such as bandwidth consumed, time spent in use, data stored, etc. These systems are especially common among IaaS providers. This approach can entail a flat fee for every increment used, discounts at articulated milestones, or a progressively cheaper price for each additional increment; but the key feature is that users can potentially incur an unlimited bill, albeit one that expressly correlates this cost with the value created by use. When used in connection with a credit system, or prepaid blocks, protection exists for unexpected costs, although usage outages upon credit exhaustion create extraordinary risk, depending upon the solution usage. Use analytics can help address each of these issues, with a notification credit line being established to replenish credits or similar notifications related to the billed metric and accrued costs to allow intervention in that metric by the customer.

Freemium Models

The most common SaaS freemium model gives users a limited or tiered version of the product under a free subscription and then offers a more robust, paid so-called premium version. This limited version helps demonstrate the product and is calibrated to provide just under that functionality or use features (capacity) that most users need (using data driven user analytic metrics to determine this). That of course encourages upgrades to the paid version, while all the while enabling the SaaS provider to gather valuable user data, inform customers about its solutions (and company), and continue to build a larger user base. Sometimes this free version will also be supported by imbedded advertisements.

Another freemium variant allows the user access to the entire product, with few or no features excluded; but access is limited in duration. After the time limit is reached, the user must either upgrade or lose service. This approach may lose users after the trial ends, but by testing a better version, users may be more likely to convert to a paid plan. Sometimes SaaS companies provide this free trial as the beginning of a paid subscription, with users able to cancel at the end of the free period. This extra effort can deter some customers from canceling.

The user relationship in freemium is unique. With freemium, the software provider targets the end-user as the benefit acquired rather than a specific revenue stream. This seeks to exploit the collapsing absolute distinction between consumer and enterprise software, as often times the entry level of the software is meant for consumers, the mid-range for small groups, and the high-end for larger enterprises; and offering a free product to consumers is the entry point to a paid enterprise version. An example of this is Google Documents which offers free productivity software to individuals or small teams but offers an enterprise version to businesses for an upgrade fee.(4)

Free Models

Then there are truly free products: no premium versions, no entry pricing, and no free trials. These products are supported almost exclusively by advertisements, either embedded from a partner or by direct charges. When embedded from a partner such as Google, reimbursement is based on various methods: clicks per minute, views per minute, or other methods are used to track the effectiveness of the advertisements. The more users, the more those numbers increase. The amount received for each click or view will change depending on the company’s negotiating strength.

Two primary methods of display advertising exist. One involves persistent advertisements displayed non-intrusively, while the other involves prominent advertisements intermittently displayed to interrupt the use of the software. In this “free” model, users pay through time or productivity lost rather than through cash payments. This fee model is relatively rare in the enterprise, as opposed to consumer market.

Cost Savings and Benefits

SaaS and cloud delivered solutions offer users clear economic savings: being able to pay more commensurate with benefit (i.e., use), reduced total cost of ownership, predictable software and related expenditures, outsourced expertise, faster implementation and deployment, and easier scalability. Non-economic benefits such as more conveniently and efficiently being able to use, always, an up-to-date product without constant “upgrades” and business disruption are also compelling. And the relative ease with which innovation can occur, with the vastly reduced costs associated with the launching of an enterprise level SaaS solution exploiting cloud services, means more market fermentation and choices for enterprises seeking ways to improve their business operations through the use of technology.

An Example

Customer Relations Management or CRM software helps companies manage interactions with their customers. It can be used in sales, marketing and technical support roles. Typically, it is sold through a suite of software that covers many of the basic uses but allows companies to expand and customize the software in order to meet their needs.

The traditional method of selling CRM is through a single license. One of the most popular solutions is Oracle Siebel. It requires purchase of a Base license for $3,750 per user and an additional $825 per user to obtain updates and support. This includes recurring updates for five years from the time of purchase; however, the updates do not increase product functionality, unlike the SaaS variant. (For example when Salesforce bought Chatter, it was included in all editions, but had it been Oracle, the new functionality would have incurred an additional charge.) From there it becomes more customizable. Additional software can be purchased for a particular sector or purpose for an additional fee, usually between $60 and $1,000 plus updates and support fee. For purposes of this example, assume one only needs Sales and Support software. At Oracle, this costs an additional $1,350 + $297 and $3,805 + $837 respectively. This totals $10,864 per user; and while this is a permanent license, it is a significant cost. (5)

On a SaaS model, CRM companies tend to use periodic payment subscription pricing, rather than token-based pricing models which are used more for hosting or processing in the cloud. Freemium use in the cloud is typically a free trial or a free version for very few users. If the focus is on enterprise, defined as software meant for at least fifteen users, most free versions are disqualified. Salesforce offers its enterprise version as the most popular edition, including Sales CRM as well as many other tools that would have cost extra with Oracle. The cost is $125 per month per user with a one-month free trial, plus the $135 per month per user enterprise version of the support software, for a total of $255 per month per user. (6) The closest analog to a freemium enterprise comparable product would be a solution like SugarCRM, an open-source CRM. Because its recommended software also includes Sales and Support pieces, as well as marketing and other features, the freemium cost of the open-source product is $45 per month per user. (7)

Although legacy software is owned outright upon purchase, the cost of acquiring this ownership takes more than three and a half years on the periodic subscription comparable, Salesforce (not including any built-in maintenance fees paid on the legacy license). And SugarCRM is even cheaper. Even without the non-economic benefits that SaaS software provides, the cost of deploying a SaaS solution seems to make SaaS an economically better option, at least in the short-term.

Conclusion

The SaaS software exploiting cloud capabilities provides an alternative for enterprises that is easier and less costly to deploy, and less costly at the very least over the short term, than legacy solutions. More pricing models are available as well, with customers able to select an approach more consistent with their intended use of the solution. The innovation associated with the delivery of technology or new software applications manifests itself in the delivery model of this software, as SaaS, supported by cloud services. Business models, too, can be innovative, and the coupling of the technical innovation and reduced scaling costs associated with SaaS delivered cloud solutions with the business model innovations makes clear that the legacy software architecture and business model is increasingly of more historical than commercial relevance.

- Hotel News Resource, Revenue Management Automation: Luxury or Necessity?, Bernard Ellis, May 11, 2010.

- Bessemer Venture Partners, Bessemer’s Top 10 Laws of Cloud Computing and SaaS, Winter 2012 Release.

- Schwartz, Barry, The Paradox of Choice: Why More Is Less, New York: Ecco, 2004, Print.

- http://www.google.com/enterprise/apps/business/pricing.html

- Oracle Global Price List, Software Investment Guide – Siebel CRM Pricing, May 17, 2012

- http://www.salesforce.com/crm/editions-pricing-service.jsp

- http://www.sugarcrm.com/sugarcrm-editions-pricing?utm_expid=5402275-4